Top passive income ideas including crypto strategies for Aussies in 2025 – get inspired, mate!

UTP: AI-Driven Automation for Hands-Off Profits (But Watch for the Scams!)

First off, let's tackle those platforms you listed. In 2025, Australia's crypto regs are tightening up—ASIC's got new draft laws requiring licences for digital asset platforms, treating 'em like banks. That means legit outfits need AFSLs (Australian Financial Services Licences), and anything without is suspect. I scoured reviews, Scamwatch alerts, and Trustpilot scores. Spoiler: Most of these smell fishier than a prawn left in the sun. They're classic "Quantum" or "AI" hype jobs promising the moon but delivering a black hole for your wallet. Quantum AI alone's been flagged by ASIC as unlicensed and scam-central, with fake celeb endorsements and deepfakes galore. SolvexPrime 9.4? Low trust scores and no real user wins. Optima Fundrelix? YouTube vids scream "scam" louder than a crow at dawn.

Joke time: Why did the scammer love Quantum AI? 'Cause it's all smoke and mirrors—quantum physics for "disappearing your money"! Fair dinkum, mates, these are pig-butchering schemes: Lure you in with small wins, then lock your funds and demand "taxes" to withdraw. ASIC's taken down over 14,000 scam sites in the last couple years, and these fit the bill.

For a quick squiz, here's a table comparing 'em based on 2025 data from reviews, ASIC warnings, and user reports. Ratings out of 5—sheilas and blokes, steer clear if it's under 2.

| Platform | Legit/Scam Rating (2025) | Claimed UTP | Reported Returns | Red Flags (ASIC/Reviews) | Alternatives (Legit Ones) |

|---|---|---|---|---|---|

| Optima Fundrelix | 1/5 (Scam) | AI auto-trading with 96% accuracy | Up to 25% | Low Trustpilot, ASIC unlicensed | Use Binance for staking |

| SolvexPrime 9.4 | 1.5/5 (Scam) | Pulse tech for multi-asset trades | 20-30% | Fake reviews, no AFSL | Kraken lending |

| InvestProAi | 1/5 (Scam) | AI predictions, no fees | 96% success | FCA warnings, celeb fakes | Coinbase Earn |

| Bitlionex Port | 1/5 (Scam) | Portfolios with crypto ports | High yields | Very low Scamadviser score | Independent Reserve |

| Quantum AI | 0.5/5 (Scam) | Quantum computing for trades | Massive ROI | ASIC alert, deepfakes | Gemini staking |

| Cryptoflux69 | 1/5 (Scam) | Flux mining with 69x gains (dodgy!) | Unrealistic | No real audits, scam lists | Swyftx for yields |

| Quantum BitQZ | 0.5/5 (Scam) | BitQZ quantum boosts | 50%+ | Impersonation scams | Aave lending |

| Anchor Gainlux | 1/5 (Scam) | Anchored gains with AI | 25% | New scam alerts, low trust | Uniswap liquidity |

| Redford Bitspirex | 1.5/5 (Scam) | Spirited bits for pro trades | 96% precision | Fake experts, no reg | Ethereum staking |

| TikProfit Investment | 1/5 (Scam) | TikTok-style quick profits | Fast ROI | Network of fake platforms | Binance Earn |

| Lucent Markbit | 1/5 (Scam) | Lucent marks for bit trades | 97% accuracy | Scamadviser low, user complaints | Polygon yields |

| Horizon AI | 1/5 (Scam) | Horizon views with AI | Broad assets | Impersonation warnings | Solana staking |

| Blackrose Finbitnex | 1/5 (Scam) | Blackrose finance nets | Automation | FCA-like warnings, scams | Cardano pools |

| Westrise Corebit | 1/5 (Scam) | Core bits rising west | High automation | Poor Trustpilot, scam vids | DeFi on MetaMask |

Overall, 2025 data shows 90%+ of these are on scam lists or have ASIC warnings. UTPs like "quantum AI" are just buzzwords—real platforms don't need 'em to work. If it promises "96% success" without risk, it's a rort. Stick to ASIC-registered exchanges; check their register online. No legit platform hides behind YouTube hype.

10 strategies for passive crypto income in 2025 – staking, lending, and more for Aussies.

UTP: Staking Smarts for Steady Shekels in 2025 (No Scams Attached)

Righto, now for real strategies to earn passively on crypto in Australia this year. Passive means set it and forget it—like a slow cooker for your portfolio. With ASIC's new rules kicking in late 2025, focus on licensed platforms to avoid tax headaches or freezes. ATO treats crypto as CGT assets: Hold over 12 months for 50% discount, report everything by Oct 31. Here's how to rack up the bucks without day-trading like a madman:

- Staking: Lock up coins like ETH or SOL on platforms like Kraken (ASIC-friendly). Earn 4-12% APY in rewards. Strategy: Pick Proof-of-Stake chains; in Oz, use tax tools like Koinly to track. Joke: Staking's like putting your crypto in a term deposit—except it might hop like a roo if prices jump!

- Lending: Lend via DeFi like Aave or Compound. Yields 5-15% on stablecoins. Aussie tip: Use AUD-pegged ones to dodge forex tax. Start small, diversify—don't chuck all eggs in one basket, or you'll end up with an omelette of losses.

- Yield Farming: Provide liquidity on Uniswap or PancakeSwap for fees. 10-50% APY, but volatile. 2025 trend: Layer-2 farms on Polygon for low fees. Pro strat: Use impermanent loss calculators; report as income.

- Crypto Savings Accounts: Platforms like BlockFi (if back) or Nexo offer 5-8% on holdings. Ensure they're AU-compliant—ASIC requires disclosure.

- NFT Royalties or Airdrops: Buy blue-chip NFTs; earn royalties on resales. Or hunt airdrops from projects like Optimism. Passive? Yep, once set.

Deep dive: In 2025, with ETH 2.0 mature, staking's king—over 20% of Aussies are in it per surveys. Risk? Volatility, but diversify across BTC/ETH/stablecoins. Start with $1k; compound rewards. Tax-wise: Rewards are income at receipt, disposals are CGT. Use ATO's online tool for calcs.

Warning signs of crypto scams – keep your hard-earned safe, mates!

UTP: Scam-Spotting Superpowers (Don't Get Done Like a Dinner)

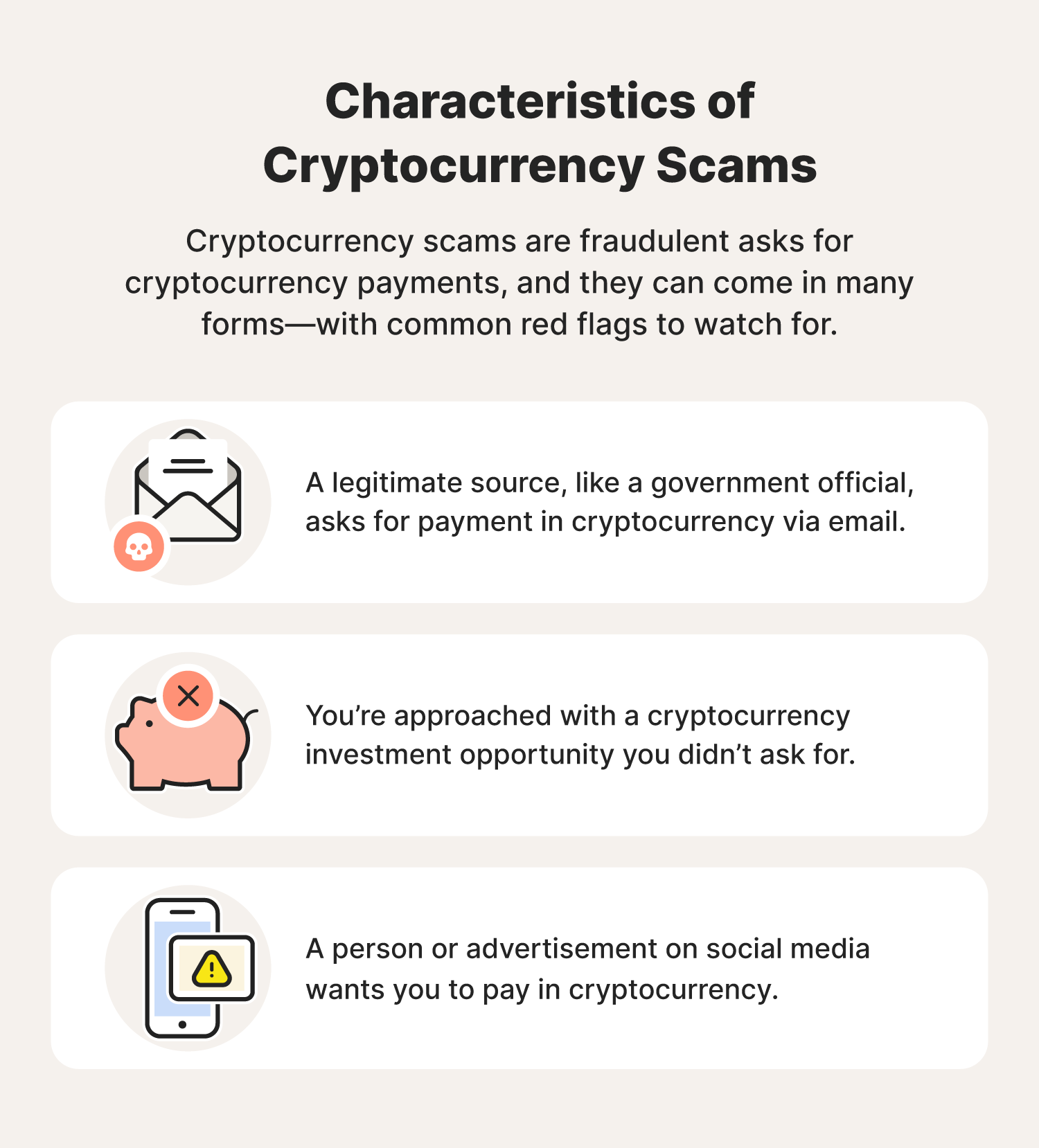

To not get stung: Red flags include unsolicited offers, "guaranteed" returns over 20%, pressure to invest quick, or fake apps. Check ASIC's investor alert list—Quantum AI's on it! Use Scamadviser or Trustpilot; anything under 2 stars is suss. Verify AFSL on ASIC site. Joke: If it sounds too good, it's probably a scam—unless it's free beer at the pub!

Real ways: Research on Reddit/AusFinance, use 2FA everywhere, and never send crypto to "recover" losses—that's a double scam. In 2025, AI deepfakes are rife, so triple-check celeb endorsements.

Australian crypto regs in 2025 – ASIC keeping it fair dinkum.

UTP: Easy-Peasy Rego, Login & Withdrawal Guides (Aussie-Style)

For legit platforms (e.g., Binance AU or Swyftx):

- Registration: Head to the site/app. Click "Sign Up"—enter email, phone, create a strong pass (no "gdaymate123"). Verify ID via KYC: Upload driver's licence or passport. Takes 5-10 mins; ASIC mandates it for anti-money laundering.

- Authorisation/Login: After rego, enable 2FA (Google Auth or SMS). To enter your dashboard: Username/email + pass + 2FA code. Forgot pass? Reset via email—easy as pie.

- Withdraw Crypto in Australia: Sell to AUD first (CGT event—calc tax). Go to "Withdraw" > Bank transfer. Use PayID for instant. ATO: Report gains; pay 0-45% based on bracket. In 2025, use ATO's crypto tool. Fees low on locals; expect 1-2 days. Pro tip: Withdraw to a bank like CommBank for seamless fiat.

Wrapping up, mates: Ditch those scam platforms—go legit for passive wins. With strategies like staking, you'll be laughing all the way to the bank. If it goes pear-shaped, hit up Scamwatch. Cheers, and happy earning!